Celebrity Brands Are Everywhere. But Do They Still Have Pull?

The first in a series on celebrity brands in 2025 — what’s working, what’s wobbling, and where things might go next

From skincare and tequila to cookware and restaurants, celebrity brands have become a staple of consumer culture. These aren’t one-off endorsements — they’re structured, capital-backed ventures launched with full-funnel strategies and experienced operators. Some are thriving. Others are quietly exiting shelves. And yet, the pipeline continues.

This piece takes a closer look at celebrity brand dynamics through the lens of beauty, spirits, and restaurants — three highly active categories that offer a snapshot of broader trends across consumer industries.

Why Now and Why Everyone’s Involved

The celebrity brand boom isn’t just about famous people trying to sell things. It’s about what those famous people — and the businesses behind them — stand to gain.

Several high-profile exits helped reshape the landscape:

Beats by Dre, co-founded by Dr. Dre and Jimmy Iovine, sold to Apple for $3 billion

Casamigos, launched by George Clooney and Rande Gerber, was acquired by Diageo for up to $1 billion

The Honest Company, co-founded by Jessica Alba, went public in 2021 with a peak market cap near $2 billion

These deals sparked more than celebrity interest. They catalyzed retailers, incubators, investors, and real estate players to get involved:

Retailers see these brands as foot traffic and PR machines. Ulta named Cécred (Beyoncé) its biggest haircare launch to date. Rhode (Hailey Bieber) made headlines for rapid growth within months of launch.

Investors and holding companies have leaned in. L Catterton backed Savage x Fenty. PE firms are targeting wellness, spirits, and luxury personal care.

Incubators like Maesa, Beach House Group, Madeby Collective, and The Center are building celebrity brands from the ground up — providing product development, ops, and launch strategy.

Real estate developers and hospitality groups view celebrity-led restaurants as foot traffic drivers — particularly in destination cities like Vegas and Miami.

And for celebrities, the incentive is clear: brand ownership offers potential for long-term equity, ongoing royalties, and greater control. This isn’t just true for actors and musicians — athletes, too, are increasingly building brands. In a world where injury, mismanagement, or short career spans can derail earning potential, launching a business can be a smart hedge.

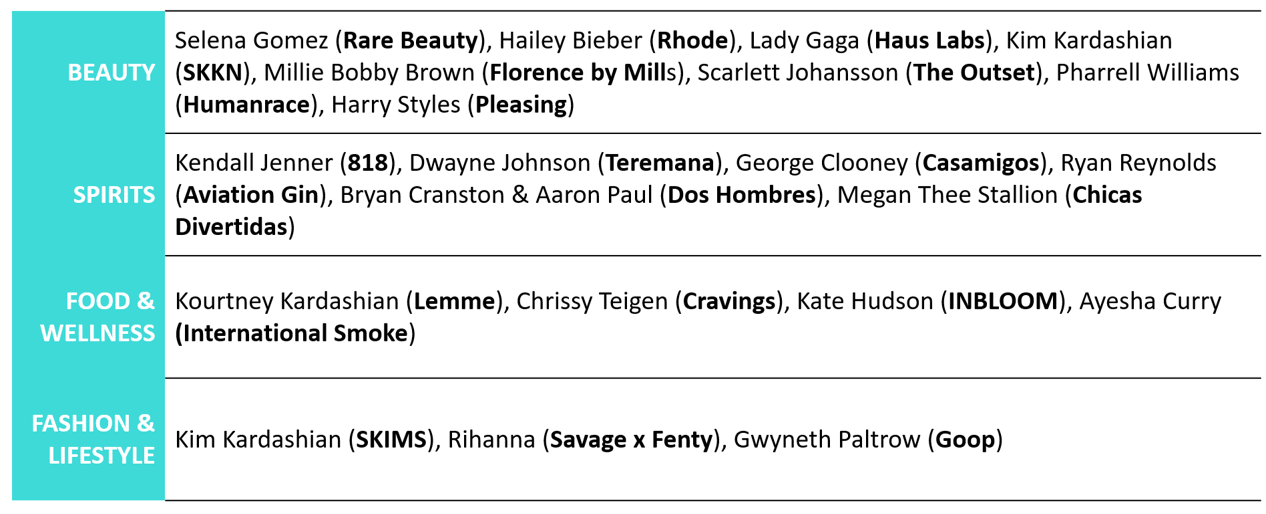

Celebrity Brand Map

The Macro View

The numbers tell a nuanced story.

In beauty, celebrity brands generated $1.2 billion in U.S. sales between November 2022 and 2023, but growth slowed from 57% to just 7% year-over-year (NIQ). In spirits, celebrity tequilas grew 16% globally in 2022 — far outpacing the broader tequila category’s 3% — while celebrity gins declined 1%, despite 4% category growth (IWSR).

Meanwhile, JLL reports that celebrity-led restaurant ventures are expanding across major markets. From Vegas to Miami, these concepts are becoming destination plays — combining cultural relevance with experiential dining.

At the same time, consumer sentiment is shifting. In celebrity beauty, Gen Z remains the largest spending demo, but Gen X saw the most growth year-over-year, according to NIQ via Beauty Independent. Some consumers still view celebrity brands as accessible luxuries — others might experience fatigue.

Beauty: A Crowded Market with Clear Winners

Beauty has seen the greatest number of celebrity entrants and also the fiercest competition. With so many launches in recent years, consumers and retailers alike are growing more selective.

The Role of Incubators

Behind many of these brands are incubators. Maesa (Drew Barrymore’s Flower Beauty, Eva Mendes’ CIRCA), Beach House Group (Florence by Mills by Millie Bobby Brown, Pattern by Tracee Ellis Ross), Madeby Collective (Rare Beauty by Selena Gomez), and The Center (working with founders like Naomi Osaka and Ciara) enable fast, founder-led brand launches with backend muscle and funding.

Community as a Competitive Advantage

The most successful beauty brands have gone beyond hype. They’ve built communities.

Rare Beauty (Selena Gomez) is a standout — not just for its $350M in 2023 revenue, but for its emotional storytelling and mental health advocacy, which have created deep brand affinity.

Rhode (Hailey Bieber) tapped into its founder’s social presence and invited followers behind the scenes. Product drops felt personal, not overly produced, and the strategy worked — generating waitlists and repeat customers.

“It’s almost transcended being a celeb line, since Selena is involved just enough to be associated with it, but it can really exist without her.” — Jessica Cruel, Allure, via The Cut

What’s Working

Rare, Fenty, and Haus Labs have gained loyalty through performance, accessibility, and smart positioning. They’ve also scaled thoughtfully — not rushing into every category at once.

What’s Not

JLo Beauty was removed from Sephora in early 2024

Kylie Skin was criticized for launching with a walnut scrub — a formulation long discouraged by dermatologists

Florence by Mills (Millie Bobby Brown) faced backlash after an early product demo video came across as inauthentic

“There is no serum that can make a 50-year-old look two decades younger — and yes, we know that butt is fake.” — Lucie Greene, Light Years Consultancy, via NYT

Business Takeaways

Retailers are growing more discerning — and demand is cooling

Brand connection and product performance matter more than name recognition

Community, clarity, and consistency are increasingly the make-or-break factors

Spirits: Still Sizzling — But Starting to Fragment

Spirits remains a lucrative category for celebrity brands, especially in tequila, rum, and premium RTD (ready-to-drink). The right founder + format combination still carries momentum — but competition is increasing.

Case Study: Casamigos

George Clooney and Rande Gerber didn’t just lend their names. They created Casamigos for themselves — literally. It was originally a private-label tequila for friends and family, focused on smoothness and ease, not flash. They scaled it slowly, prioritized taste, and brought in smart operational partners. When Diageo acquired the brand, it wasn’t just buying the name — it was buying a brand with traction.

“We wanted the best-tasting, smoothest tequila that didn’t have to be covered up with salt or lime.” — Clooney, via CNBC

What’s Working

Casamigos, Teremana (Dwayne Johnson), Aviation Gin (Ryan Reynolds), and 818 (Kendall Jenner) have built out distribution and brand equity

Drinkers under 40 are still open to new brands — especially in tequila and mezcal

Founders who pair their image with a compelling brand story and strong operational teams tend to last

What’s Not

Celebrity gin, vodka, and even some newer tequila brands have faced fatigue. A name can drive curiosity — but only a few deliver repeat purchase.

Business Takeaways

Packaging and persona matter — but so does product

Liquor is a relationship-based business — from distributors to on-premise partnerships

Brands with long-term upside invest early in quality and credibility

Restaurants: Relevance Over Novelty

Celebrity-owned restaurants aren’t new — but the latest wave reflects a smarter, more brand-aligned approach. In the past, concepts like Planet Hollywood (founded by Sylvester Stallone, Bruce Willis, and Arnold Schwarzenegger) and Fashion Café (Naomi Campbell, Claudia Schiffer, Elle Macpherson) captured public imagination with glitzy launches and big names. While Fashion Café disappeared quickly, Planet Hollywood still exists today — primarily in Las Vegas and international resort destinations — having evolved beyond its original star-powered roots into a tourism-centric brand.

The current wave looks different. Some concepts still lean on spectacle — especially in cities like Vegas and LA — but others reflect personal, grounded bets with a long-term lens.

Case Study: RPM Italian

Giuliana and Bill Rancic partnered with Lettuce Entertain You to build RPM, a stylish Italian restaurant that expanded from Chicago to Las Vegas. It isn’t a theme park. It’s a business — and it works because it aligns with the founders’ lifestyle positioning and audience.

What’s Working

Vanderpump à Paris, Big Chicken (Shaquille O’Neal), and Buddy V’s Ristorante (Buddy Valastro) thrive by pairing strong branding with experienced hospitality partners.

Las Vegas remains a launchpad for celebrity-led restaurants — with entries from Martha Stewart, Gordon Ramsay, and others drawing both press and foot traffic.

Trejo’s Tacos (Danny Trejo) and Chicken + Beer (Ludacris), both launched in 2016, continue to operate successfully. They don’t rely on press cycles or cameos — just well-run concepts with smart real estate and cultural resonance.

Walton’s Fancy & Staple (Sandra Bullock), a deli and bakery in Austin, doesn’t look or feel like a celebrity brand — and that’s part of its staying power.

“The acting is to fund what I do here in Austin,” Bullock told the Austin American-Statesman, underscoring a long-term mindset that separates lasting ventures from short-term brand plays. (Yahoo)

What’s Not

International Smoke (Ayesha Curry) closed multiple locations after initial buzz — a reminder that celebrity visibility doesn’t always translate to operational scale.

Many newer ventures are still in early phases; time will tell which can run without their founder in the room.

Gimmick-heavy concepts or one-note themes tend to fizzle once the novelty wears off.

“You can’t outsource everything and still expect loyalty. Hospitality doesn’t work like Instagram.” — JLL Retail Report

Celebrity as a Risk Factor

Celebrity can drive attention — but it can also invite volatility.

A public misstep, controversy, or overexposure can affect not only the person, but the brand tied to them. We’ve seen retailers and investors cut ties when a founder’s image becomes a liability. And in an age of constant visibility, some consumers might experience fatigue when one person is behind multiple ventures, endorsements, and campaigns.

Brands that rely too heavily on personality — without product, values, or story — are most vulnerable.

Where This Might Be Going

Retailers are pulling back — shelf space is about performance

Consumers are less starstruck — they expect more from every launch

Authenticity is being redefined — no longer about kitchen tables and home labs, but about clarity, conviction, and cultural relevance

What to Watch

More quiet exits in beauty and spirits

Capsule models and collabs over full-scale solo launches

Celebrity brands that work — because they don’t feel like celebrity brands

A Personal POV

I’ll admit it — I tend to roll my eyes when yet another tequila or makeup brand drops with a celebrity name attached. Most of the time, I just find it … boring.

That said, I don’t begrudge any celebrity the desire to diversify. Fame is fleeting, and Hollywood favors the young — so it’s smart to think ahead and build something with longevity. I’m not naturally drawn to celebrity brands just because of the founder, but I’ll try one if it comes recommended.

Still, the overexposure is real. Some celebrities are attached to so many ventures that their brand presence stops feeling special. Sometimes... they just need to go away for a while so fans can miss them. (Kidding, sort of.)

If I were a celebrity looking to invest in a brand, I’d do it quietly — choosing something strong enough to stand on its own without relying on my name. Or I’d join forces with a non-celebrity co-founder and let the product lead. And if I owned multiple brands? I definitely wouldn’t be the face of all of them.

What Do You Think?

Is there a celebrity brand you actually love? One you pretend to hate but secretly use? Do you see this trend maturing or just multiplying?

I’d love to hear what resonates with you — reply, comment, or forward this to someone who’s been watching this wave too.

Up next in the series: a look at the long, complicated history of celebrities and consumer brands.

this was a fantastic and in depth read. i especially loved how you highlighted that celebrity can also be ripe for volatility! i agree completely on your note that if you were a celeb you would not rely on personal brand alone, but rather leverage someone else's likeness. No notes!!